A sales funnel for insurance differs from your average sales funnel and never works in the same way. Instead, it entails multiple marketing touchpoints. So, if you have just started out in the ever-growing and complex field of insurance marketing and sales, here’s the perfect guide for you as it tells you how to create a sales funnel for insurance.

How an Insurance Sales Funnel Differs from Other Sales Models

Sales funnel is a customer-centered marketing model that exhibits a customer’s journey toward buying a specific product. Typically, the sales funnel consists of four primary stages:

- Product/brand awareness

- Increasing interestin the product or the company

- Establishing a desireto purchase the product by highlighting its key features and benefits

- Encouraging the consumer(s) to take action, i.e., finally buy the product

Like a typical sales funnel, an insurance sales funnel comprises the same components but with a few variations. It involves:

- Product awareness

- Taking opinions from peers

- Brand and product consideration

- Evaluating the features and benefits

- Brand preference based on peers’ opinions and past experience

- Purchase decision

Each stage of the sales funnels for insurance somehow influences your customer’s buying behavior. Now that you know how an insurance sales funnel is created and how it differs from an average sales funnel, let’s examine each of the six stages:

1. The Awareness Stage

Creating awareness for your product is the first stage of every sales funnel, including insurance. This is called the top of the funnel (TOFU). You can create awareness of your product/services for your customers using an array of different sources, such as handouts, webpages, billboards, social media, and digital marketing campaigns like PPC advertisements, emails, and more.

While this stage might sound like a routine process for any business, it only gets more complex. It is relatively costly to create awareness. Even if you have the resources to build platforms, both digital or traditional brick-and-mortar, you must challenge your rivals and their offerings.

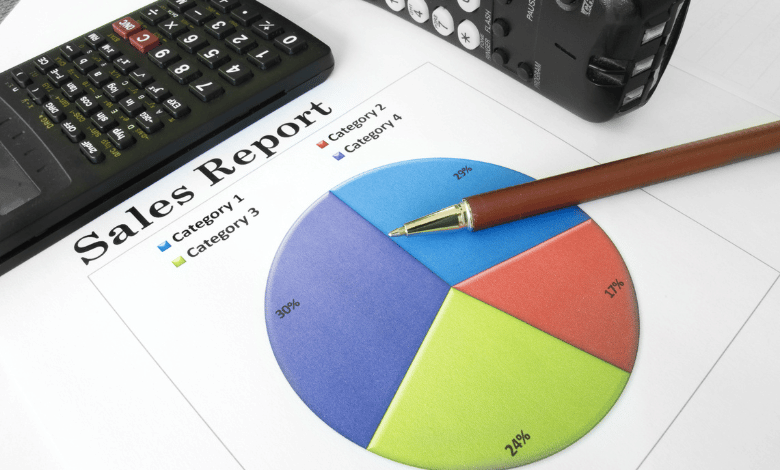

Without a surprise, the costs for insurance digital marketing in the United States far exceeds every other sector by almost 8%. Here are two things that are vital in influencing your customers in this stage of your insurance sales funnel.

- Timing: Understand if your customer is ready to purchase an insurance policy at this particular moment and whether your marketing strategy will influence them to move on to the next stage.

- Wrong Targets: Your SEO campaigns and PPC ads aren’t targeting customer demographics, for instance, life insurance ads on websites or apps for kids or auto insurance ads for people who don’t own a vehicle.

2. The Opinion Stage

The following stages – Peer Opinion, Consideration, and Evaluation are significantly connected in a complex way. This is because a customer’s thought process often wavers between these three stages during the purchase cycle.

Your brand’s authority considerably influences the opinion stage of your customer’s buying process. As an insurance agent, the brand you sell or promote is bound to affect your customers’ buying decisions. This is the make-or-break deal for insurers.

Your ad campaigns, website, landing pages, etc., play a substantial role in establishing your brand image. If these elements fail to resonate with your customer’s mindset, they won’t be able to seamlessly transition into the following stages of the purchase process.

3. The Consideration Stage

Every bit of information is available at the tip of our fingers in the digital world. Hence, as an insurance salesperson, you must carefully communicate with your customers and potential leads. Here are the following things that can adversely affect your sales:

- Wrong and misleading information or offers: This is a huge no because it can adversely affect your sales.

- No-follow-up campaigns: This is a widespread mistake made at the hands of most insurance marketers.

- Competition: Your target demographic is receiving better and more competitive insurance policy quotes than yours.

4. The Evaluation Stage

It can be incredibly infuriating and distressing to put considerable time and effort into making customers aware of their needs only to purchase an insurance policy from your competitor. Here are some things you must ensure to follow:

- Conduct thorough competitor analysis and check your product-market fit.

- Always communicate the right and up-to-date information to your sales/marketing team.

- Follow up rigorously to prevent missing potential leads.

5. The Preference Stage

This stage is about influencing potential leads to choose you over your rivals. You can encourage them to give you more preference by sending enticing offers and elaborating on the benefits upon signing up with you. Effective communication allows you to win over leads and convert them into customers.

6. The Closing Stage

This is the final stage of the insurance sales funnel, meaning your sales skills will surpass all others, and the ball is finally in your court. With the help of a robust sales strategy and regular follow-ups, you can acquire customers and retain them for life.

- Closing Strategies:Your salesperson must have complete knowledge of the subject besides only being adept at sales. A closed deal is the first win, but you should also focus on upsells and cross-sells as they fuel your business.

- Follow up again:only a tiny percentage of the sales occur during the first contact, while the rest follow by rigorously conducting follow-ups.

In the end, you must address any sort of customer concerns, cost concerns, and timing issues peacefully to make your customers advocates of your product/service.

Check More Of Our Content Down Below

When Will The Metaverse Take Over | Metaverse

What Happens When You Die in The Metaverse [Guide]